More than a third of central banks around the world are looking to link regulatory requirements to ESG principles.

In Bahrain, where the financial sector was the largest non-oil contributor (17.3%) to real GDP in 2020, financial institutions are increasingly aware that core operations, culture, policy and governance need to be better aligned with economic, social and governance (ESG) leading practices – and that ESG expectations are evolving among regulators, investors, stakeholders and customers.

ESG landscape in the financial sector

The thought process behind ESG is a major contributor to both Bahrain’s economic vision – as underlined by its commitment to addressing the 2030 sustainability development goals (SDGs) – and the sustainability of the private sector. ESG maturity is not about building a stronger brand – it is increasingly a significant criterion for stakeholder and investor decisions.

The ESG maturity of a financial institution is a reflection of its ability to identify ESG risks and opportunities – and their optimal usage. ESG values must be embedded in the culture of an entity and its business strategy. From cultural changes, business decisions and supply chain management to simple marketing information, ESG impacts each area of a financial institution.

What is driving the integration of ESG issues within the financial sector?

While regulators are encouraging financial institutions to improve ESG risk management and develop more sustainable business practices, market and regulatory factors are also playing their part in promoting ESG practices:

Cultural integration

Culture adds a vital human lens to ESG assessments. Embedding ESG principles within a financial sector business encourages the involvement of people in the manifestation of its purpose.

While decision-makers reform business models and strategies to better fit ESG parameters, policy-makers are acting at operational and people on level. Delivering on environmental and social targets has become a part of strategy. Corporate culture has to evolve in support – if not lead – that strategy. An open-minded, inclusive work force that is aware of its climate, social and environmental responsibilities can deliver better, including ESG scoring, employee satisfaction, brand image, customer satisfaction, carbon and plastic footprint and human resource performance.

Policy integration

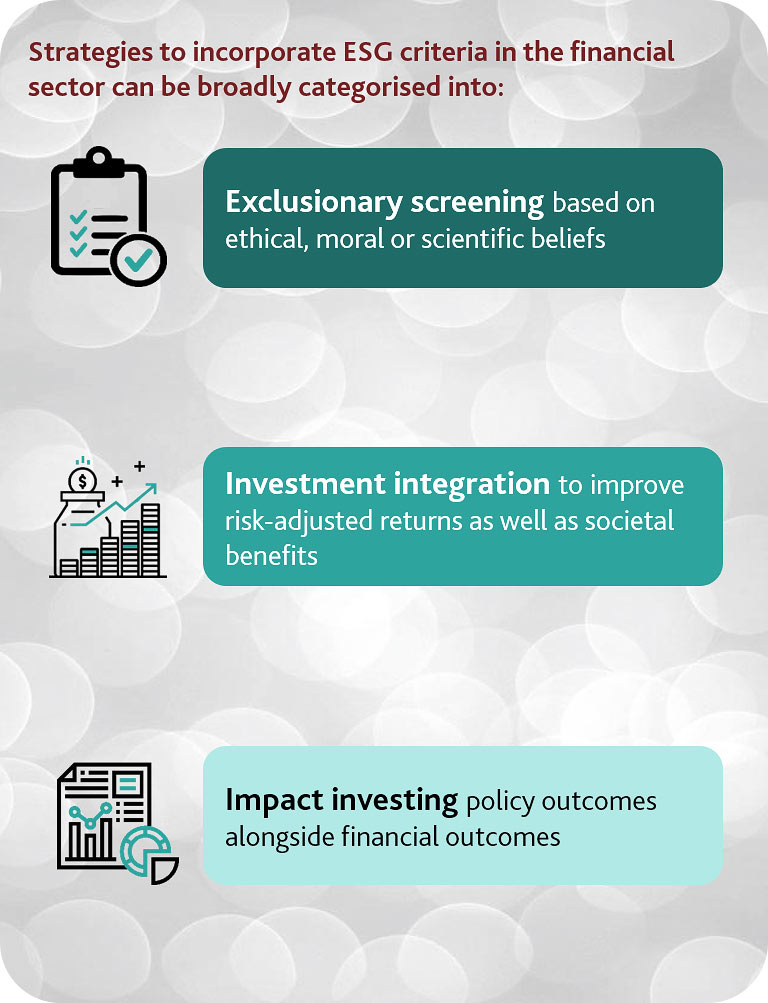

Risk and returns are impacted by a large number of ESG factors. Integrating policy with ESG parameters impacts decisions on investment, underwriting and risk management. Most financial institutions end up evaluating ESG impact on their core strategies and business models.

Financial institutions must align their policies, risk management and business practices with an ESG mindset to establish core beliefs on how to achieve sustainability, align expectations, communicate commitment to stakeholders and establish a framework for successful implementation.

To better align capital with activities that do not have an adverse impact on society or the environment while simultaneously enhancing financial resilience, appropriate due diligence is critical to the size and significance of financial institutions’ lending and underwriting activities.

Governance integration

Investors and stakeholders are calling for transparency around diversity, equity and inclusion (DEI) – encouraging multiple perspectives and skillsets that will enhance long-term performance at board and senior management levels.

Financial institutions can address DEI by being transparent – and showing leadership. Transparency leads to accountability that leads to opportunities for everyone to advance. Leading DEI practice and disclosure expectations need to be understood and adapted by financial institutions who are looking to enhance the diversity of boards, management teams and workforces.

Financial institutions must consider practices – set at the top – relating to regulatory compliance, the conduct of officers and directors and expectations of integrity. Concerns range from accurate and transparent financial reporting, executive compensation practices and diversity and inclusion to the avoidance of conflicts of interest and corrupt practices. The composition of boards and executive teams should also be considered, ensuring representatives are appropriate to address stakeholders’ concerns and potential ESG risks.

Financial resilience

Financial institutions need to focus on sustainability, long-term resilience and managing material risks to increase profitability and performance.

Stakeholders are increasingly focused on financial institutions’ long-term strategic visions, including ESG integration and implementation. Integrating ESG factors with risk management processes, stress testing, due diligence and portfolio impact assessments have been shown to improve overall performance. Sustainable investment strategies, especially in the light of COVID-19, have shown the importance of ESG for financial health and profitability in the financial sector.

Transparency in communication

Making sense of ESG data and disclosures is a key ESG reporting requirement. With a lack of standardisation and overlap between different metrics, financial institutions can struggle to find a standardised methodology to evaluate, report and disclose ESG data.

Marketing and corporate reporting plays an integral role in the communication between financial institutions and their stakeholders, which is subject to many regulations, laws and guidelines.

Financial institutions are expected to deal with stakeholders fairly and responsibly. Fair and responsible marketing and corporate communication requires financial institutions to communicate transparently about the economic, environmental, and social impacts of their products and services.

Operational integration

The financial sector should embed sustainability practices into their supply chains.

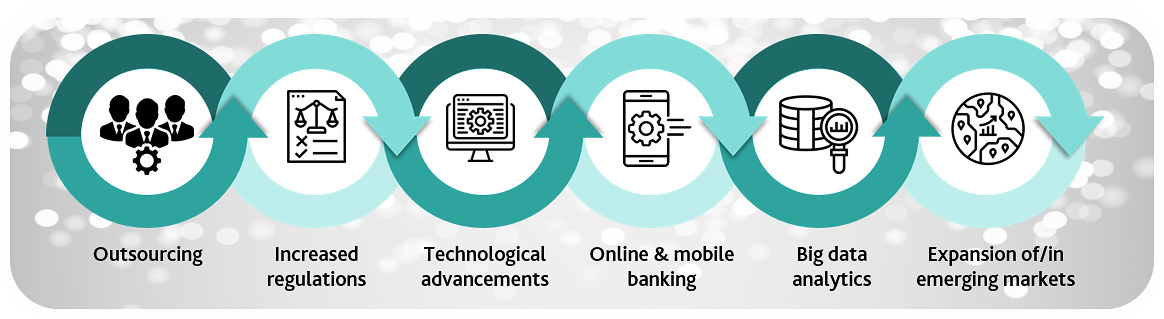

Emerging ESG trends that impact supply chains in the financial sector

Key sustainability issues across the financial sector’s supply chain

Conclusion

The financial sector needs to adapt and respond to how expectations regarding ESG are evolving among regulators, investors, stakeholders and customers. Embedding ESG principles within core operations, cultural, policy and governance aspects is crucial to any financial institution for achieving sustainability and resilience.

What can Keypoint offer?

- Develop and roll out ESG strategies

- Help implement ESG policy and strategies

- Assess ESG performance against Bahrain Bourse’s KPIs

- Manage ESG risks and opportunities

- Support ESG integration exercises

- Advise on current market and global ESG trends, including ESG-driven changes to culture and operations

- Develop ESG reports as a part of management or annual reports